Unlocking Hidden Value Through Strategic Land Division

when properly executed, subdivision can transform a modestly performing single asset into multiple high-value parcels that collectively command 50-100% more than the original property’s value.

having guided dozens of property owners through subdivision projects across carbon county’s varied municipalities, i’ve seen firsthand how the difference between mediocre returns and exceptional profitability often comes down to understanding the nuances of local regulations, market demand, and property-specific opportunities.

this isn’t simply about drawing lines on a map—it’s about recognizing when subdivision makes financial sense, navigating complex regulatory frameworks, and implementing approaches that maximize both marketability and return on investment.

recognizing subdivision potential: key indicators

not every property is a strong candidate for subdivision. identifying true opportunity requires evaluating several critical factors:

market demand signals

strong market fundamentals must support subdivision economics:

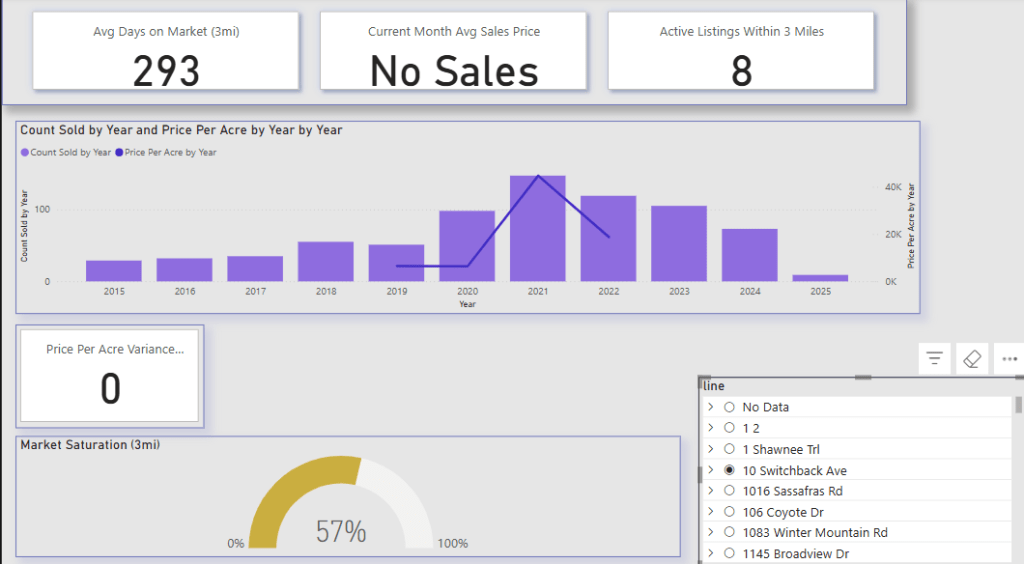

- Absorption rates: smaller parcels consistently selling faster than larger ones in the area

- Price-per-acre differentials: significant premium (typically 30%+) for smaller vs. larger parcels

- Days-on-market metrics: shorter marketing periods for appropriately sized lots

- Competitive inventory levels: limited supply of similar-sized parcels

- Buyer profile evidence: demographic data supporting demand for specific lot sizes

these signals vary significantly across carbon county. in penn forest township, for example, 1-3 acre residential parcels have consistently commanded 40-70% higher per-acre values than 10+ acre tracts, with dramatically shorter marketing periods. conversely, in more rural townships, this differential might be minimal or even reversed for certain property types.

physical property indicators

certain property characteristics naturally suggest subdivision potential:

- Multiple access points: existing or potential entrances from different roads

- Distinct natural divisions: streams, ridgelines, or other features creating logical separation

- Varied terrain: different areas suited to different uses

- Irregular shape: configurations that could be more efficiently reorganized

- Multiple buildable areas: separated potential home sites

these physical characteristics often indicate untapped value. one client in towamensing township owned an irregularly shaped 22-acre parcel with road frontage on two different streets. by subdividing along a natural ridgeline, they created three highly marketable parcels that sold for a combined value 76% higher than comparable single-parcel sales in the area.

regulatory opportunity indicators

favorable zoning and regulatory conditions support successful subdivision:

- Minimum lot size compatibility: current zoning allows division into marketable parcels

- Frontage/width requirements: property configuration permits compliant lot creation

- Favorable subdivision ordinances: reasonable process without prohibitive requirements

- Water/septic feasibility: soil conditions supporting multiple on-lot systems

- Absence of restrictive covenants: no private restrictions prohibiting division

these regulatory factors vary dramatically across carbon county’s 23 municipalities. what might be a straightforward subdivision in mahoning township could be economically unfeasible just across the border in east penn township due to different minimum lot size requirements or road improvement standards.

economic feasibility indicators

solid financial fundamentals must support the subdivision investment:

- Value creation potential: significant premium probability (typically 50%+ over whole-parcel value)

- Reasonable development costs: site conditions supporting cost-effective improvements

- Manageable carrying costs: property tax and maintenance implications during marketing

- Marketing timeline alignment: realistic absorption rates matching your investment horizon

- Financing implications: available capital resources supporting the development process

these economics vary both by location and project scale. a recent subdivision project in penn forest township created six residential parcels from a 28-acre tract, generating a 115% return on investment after accounting for all development costs and a 14-month marketing period. conversely, a similar-sized project in a less desirable area might not justify the development expense.

carbon county’s subdivision regulatory framework

understanding carbon county’s multi-layered regulatory structure is essential for successful subdivision projects:

township-specific ordinance variations

substantial differences exist between municipal requirements:

- Penn Forest Township: relatively streamlined minor subdivision process, moderate improvement requirements

- Kidder Township: more extensive environmental review, substantial infrastructure standards

- Jim Thorpe Borough: historic district considerations, complex utility connection requirements

- Lower Towamensing Township: straightforward process for 1-3 lot divisions, more intensive for larger projects

- Franklin Township: moderate requirements with emphasis on stormwater management

these differences directly impact project feasibility and profitability. one client subdividing identical-sized parcels in adjacent municipalities discovered that development costs in kidder township were nearly 40% higher than in neighboring penn forest township due to more stringent improvement requirements.

minor vs. major subdivision classifications

understanding these distinctions is crucial for efficient planning:

- Minor subdivisions: typically 1-3 lots with minimal infrastructure requirements

- Major subdivisions: larger projects requiring more extensive improvements and reviews

- Process differences: simplified approval path for minor subdivisions

- Timeline implications: minor projects typically 2-4 months, major projects 6-18+ months

- Cost distinctions: exponential increase in engineering and improvement costs for major projects

structuring projects to qualify as minor subdivisions when possible creates significant advantages. one client in towamensing township saved approximately $28,000 in engineering and review costs by phasing their project into two separate minor subdivisions rather than a single major subdivision plan.

conservation district requirements

environmental regulations create additional compliance considerations:

- Erosion and sedimentation controls: required for most earth disturbance activities

- NPDES permit thresholds: triggered by disturbance exceeding 1 acre

- Wetland protection standards: buffer requirements and development prohibitions

- Stormwater management requirements: volume and rate control standards

- Review timeframes: additional 30-60 days for many projects

strategic project design to minimize environmental impacts often yields significant savings. a client in penn forest township reduced their conservation district compliance costs by approximately $22,000 by carefully siting roads and utilities to minimize earth disturbance below NPDES permitting thresholds.

sewage facilities planning requirements

on-lot septic considerations significantly impact subdivision potential:

- Planning module requirements: most subdivisions require DEP sewage planning approval

- Soil testing procedures: perc testing limited to specific seasonal windows

- Alternate system considerations: solutions for marginally suitable soils

- Groundwater protection standards: isolation distances and density limitations

- Review timeline implications: often the longest component of subdivision approval

sewage planning often represents the most significant regulatory constraint in carbon county subdivisions. one client in east penn township was able to create three additional buildable lots through strategic implementation of stream setback averaging and alternate septic system designs after initial conventional testing indicated limited capacity.

strategic subdivision approaches for carbon county properties

successful subdivision requires methodical planning tailored to specific property attributes:

market-driven configuration strategies

optimal lot layouts reflect buyer preferences in specific markets:

- Premium view capture: maximizing value-adding vistas on individual lots

- Privacy optimization: strategic placement of building envelopes for seclusion

- Feature distribution: equitable allocation of streams, mature trees, and other amenities

- Size targeting: creating lots that match proven buyer preferences in the area

- Access optimization: minimizing road costs while maximizing convenience

market-responsive design dramatically impacts both sale prices and marketing timelines. one client in penn forest township reconfigured their preliminary subdivision plan to create fewer but larger “privacy lots” based on market research showing strong demand in that specific niche. the resulting lots sold for an average of 22% more per acre than originally projected smaller parcels would have commanded.

phased development strategies

strategic implementation timing can optimize both cash flow and market positioning:

- Sequential approval approaches: securing entitlements in stages to manage upfront costs

- Infrastructure phasing: building roads and utilities incrementally as sales progress

- Strategic lot release: bringing specific parcels to market based on demand patterns

- Price progression planning: structured increases as project gains momentum

- Risk mitigation timing: limiting exposure until market response is confirmed

phased approaches often dramatically improve return on investment. a client developing a 42-acre parcel in kidder township implemented a three-phase approach that allowed initial lot sales to fund subsequent infrastructure development, reducing their capital requirements by approximately 60% compared to full upfront development.

cost-efficiency design strategies

thoughtful engineering approaches minimize development expenses:

- Road network optimization: layouts that maximize frontage while minimizing construction

- Shared infrastructure approaches: common driveways, utility corridors, and stormwater facilities

- Natural feature integration: using existing topography to reduce grading costs

- Existing resource leveraging: incorporating logging roads or historical pathways

- Regulatory threshold management: staying below triggers for more intensive requirements

engineering efficiency often determines project profitability. a towamensing township client reduced their subdivision road costs by approximately 45% by implementing a shared driveway approach rather than a full township-specification road, while still providing high-quality access to all lots.

environmental sensitivity strategies

integrating natural systems creates both market appeal and regulatory advantages:

- Conservation design approaches: clustering development to preserve significant open space

- Low-impact development techniques: minimizing disruption to natural systems

- Viewshed protection planning: preserving the visual character that attracts buyers

- Habitat connectivity maintenance: preserving wildlife corridors through thoughtful design

- Green infrastructure implementation: natural stormwater and erosion management

environmentally sensitive design often creates premium value. a client in penn forest township implemented a conservation subdivision approach that preserved 65% of their property as shared open space while still creating the same number of lots allowed under conventional zoning. the resulting parcels sold for an average of 35% more than comparable lots in traditional subdivisions, while development costs were reduced by approximately 40% due to smaller road and infrastructure requirements.

financial modeling for subdivision projects

thorough economic analysis should precede any subdivision investment:

comprehensive development cost analysis

accurate expense projection requires detailed examination of:

- Regulatory compliance costs: application fees, review expenses, and professional services

- Engineering and design expenses: survey, planning, environmental, and technical services

- Infrastructure development costs: roads, utilities, stormwater, and common facilities

- Carrying expense projection: property taxes, maintenance, and insurance during development

- Marketing and transaction costs: advertising, commissions, and closing expenses

these costs vary dramatically based on project scale and location. a typical 4-lot minor subdivision in penn forest township might entail $40,000-$60,000 in development costs before marketing, while a similar project in kidder township could require $60,000-$90,000 due to more stringent improvement requirements. major subdivisions with significant infrastructure needs often range from $20,000-$40,000 per lot in development costs.

revenue projection methodology

realistic income forecasting requires sophisticated market analysis:

- Comparable sales analysis: recent transactions of similar parcels in the immediate area

- Premium feature valuation: quantifying the impact of views, water features, and other amenities

- Absorption rate assessment: realistic timeline for complete project sellout

- Pricing strategy development: optimal starting points and potential increases over time

- Market trend integration: incorporating directional indicators into future value projections

sophisticated revenue projection prevents both unrealistic expectations and undervaluation. one client contemplating subdivision of their 35-acre parcel initially estimated lot values based on simple division of the whole parcel’s appraised value. our detailed comparable analysis revealed potential per-lot values approximately 40% higher than this simplistic approach suggested, fundamentally changing the project’s risk-reward profile.

return on investment calculation

comprehensive profitability analysis includes:

- Multiple return metrics: ROI, internal rate of return, and profit margin analysis

- Time value consideration: adjusting for development and marketing timeframes

- Scenario modeling: best-case, expected-case, and worst-case projections

- Sensitivity analysis: identifying which variables most impact profitability

- Opportunity cost comparison: subdivision returns versus alternative investment options

these comprehensive economics determine whether subdivision truly creates value. one client’s proposed 6-lot subdivision in mahoning township initially showed attractive gross profit potential, but detailed ROI analysis incorporating time value of money revealed that after accounting for the 24+ month development and marketing period, their annualized return would be approximately 8%—potentially lower than other investment options with less complexity and risk.

risk management financial strategies

prudent subdivision investment requires thoughtful risk mitigation:

- Capital staging approaches: investing incrementally as project milestones are achieved

- Pre-development marketing: securing interested buyers before significant investment

- Contingency budgeting: typically 15-25% for first-time subdivision projects

- Phased entitlement strategy: securing critical approvals before full financial commitment

- Exit strategy diversification: maintaining multiple options throughout the process

these risk management approaches often mean the difference between success and financial stress. one client implementing their first subdivision in penn forest township maintained parallel marketing of both the entire approved subdivision and individual lots, ultimately selling the entire entitled project to a builder for 80% of the projected individual lot revenue but avoiding approximately 14 months of additional carrying costs and marketing expenses.

maximizing marketability of subdivided parcels

strategic enhancements significantly impact both sale prices and marketing timelines:

high-impact, low-cost improvements

certain enhancements yield disproportionate returns:

- Strategic clearing: creating viewpoints and showcasing property features

- Access enhancement: well-designed entrances and internal road systems

- Building site preparation: identifying and minimally preparing prime home locations

- Boundary clarification: clear marking and documentation of property lines

- Feature highlighting: subtle enhancements to streams, rock formations, and other assets

these targeted improvements often yield returns of 200-400% on investment. one client subdividing a 22-acre parcel in lower towamensing township invested approximately $9,500 in strategic clearing, access enhancement, and feature highlighting across three newly created lots. these improvements reduced marketing time by approximately 40% and generated price premiums estimated at $24,000 above baseline comparable values.

documentation and information packages

comprehensive information significantly enhances buyer confidence:

- Detailed surveys: professional documentation of boundaries and features

- Soil/perc test results: confirmation of building suitability

- Environmental assessments: documentation addressing potential concerns

- Utility availability verification: clear information on service options

- Regulatory compliance documentation: evidence of proper approvals and permits

comprehensive documentation packages almost always accelerate sales and support stronger pricing. a client selling lots from their kidder township subdivision created detailed information portfolios for each parcel, including soil test results, utility connection procedures, and building requirement summaries. these packages noticeably reduced buyer hesitation and shortened the typical contract-to-closing timeline by approximately 30% compared to similar projects.

strategic seller financing

thoughtful financing options can accelerate sales and increase returns:

- Lot reservation programs: structured deposits with phased payment schedules

- Traditional seller financing: owner-held mortgages with appropriate security

- Lease-option arrangements: gradual ownership transition with defined timeline

- Builder partnership structures: creative financing for qualified contractors

- Installment sale tax planning: potentially advantageous income distribution

financing flexibility often creates significant competitive advantages in carbon county’s land market. one client offered seller financing on lots in their penn forest township subdivision, requiring 20% down with 7% interest on 10-year terms. this approach expanded their buyer pool by approximately 40% and accelerated their project sellout by an estimated 8 months while generating additional income through interest.

targeted marketing approaches

strategic promotion significantly impacts project success:

- Buyer profile targeting: identifying and reaching most likely purchasers

- Feature-specific highlighting: emphasizing attributes most valued by target markets

- Seasonal marketing alignment: timing promotions to match property’s best presentation

- Multi-channel strategies: combining online, print, signage, and network marketing

- Professional presentation materials: high-quality maps, images, and documentation

sophisticated marketing approaches dramatically impact both pricing and absorption rates. a client marketing a 5-lot subdivision in penn forest township implemented a targeted campaign focused specifically on outdoor enthusiasts within 90 minutes’ drive, emphasizing the property’s exceptional wildlife habitat and recreational opportunities. this narrow targeting generated multiple competing offers for several lots, ultimately yielding an average of 14% higher sales prices than initially projected.

case study: successful carbon county subdivision

examining a successful project provides valuable insights into effective strategies:

a client approached me regarding their 42-acre property in penn forest township, which they had purchased as an investment several years earlier. the parcel featured varied topography, approximately 1,200 feet of road frontage, and a mix of open meadows and mature woodlands. they were considering selling the entire property but wondered if subdivision might yield better returns.

our analysis revealed several favorable subdivision indicators:

- Market evidence: 2-5 acre lots in the area consistently selling for 65-80% higher per-acre values than larger parcels

- Physical attributes: natural topographic divisions creating logical lot configurations

- Regulatory compatibility: zoning allowing minimum 2-acre lots with 150′ frontage

- Development feasibility: suitable soils for on-lot septic systems throughout the property

we developed a phased approach that balanced risk management with return optimization:

- Preliminary analysis phase: modest investment in initial survey and regulatory research

- Minor subdivision first phase: creating three high-value lots along existing road frontage

- Reinvestment strategy: using proceeds from initial lots to fund internal road development

- Second phase implementation: development of four additional interior lots

the results validated this strategic approach:

- the property’s estimated value as a single 42-acre parcel was approximately $380,000

- total development costs including survey, engineering, approvals, and road construction were $124,000

- the seven resulting lots sold for a combined $782,000 over an 18-month period

- net profit after all development costs and marketing expenses was approximately $278,000

- total return on investment was 73%, with an annualized ROI of approximately 49%

key success factors included:

- phased implementation that limited initial capital exposure

- strategic lot configuration capturing premium views and privacy buffers

- cost-efficient road design utilizing existing topography

- comprehensive documentation package addressing common buyer concerns

- targeted marketing to specific buyer demographics

this approach turned a solid but modest investment property into an exceptional performer through strategic subdivision.

common subdivision pitfalls to avoid

certain recurring issues frequently undermine subdivision projects:

- Insufficient due diligence: failing to thoroughly investigate regulatory requirements before proceeding

- Underestimated timelines: not accounting for realistic approval and development schedules

- Inadequate capital planning: insufficient resources to complete the project properly

- Market miscalculation: creating lot configurations that don’t align with buyer preferences

- Overimprovement: investing in enhancements that don’t yield proportional value increases

- Professional team deficiencies: working with advisors lacking specific carbon county subdivision experience

- Documentation inadequacies: insufficient attention to clear legal descriptions and proper recording

addressing these issues proactively prevents costly mistakes. one client narrowly avoided a significant error when our pre-subdivision investigation revealed an unrecorded utility easement that would have rendered one of their proposed lots unbuildable—information that wasn’t apparent from standard title research but emerged during comprehensive due diligence.

is subdivision right for your carbon county property?

determining whether your property is a good candidate for subdivision requires careful evaluation of market, physical, regulatory, and financial factors. properties with the strongest subdivision potential typically feature:

- significant demonstrated market premium for smaller versus larger parcels in the specific area

- physical characteristics that support logical division with minimal infrastructure investment

- favorable regulatory environment without prohibitive improvement requirements

- clear value-creation potential after accounting for all development costs

- alignment with your investment timeline and risk tolerance

my approach to subdivision analysis combines detailed market knowledge with practical regulatory experience across carbon county’s varied municipalities. having guided numerous property owners through successful subdivision projects, i’ve developed assessment methods that identify genuine opportunities while avoiding common pitfalls.

as a carbon county land specialist, i offer:

- Subdivision feasibility assessment: evaluating whether your property is a strong candidate

- Regulatory navigation guidance: identifying the most efficient approval pathway

- Financial modeling: developing realistic cost and revenue projections

- Implementation planning: creating strategic approaches that maximize returns

whether you’re considering subdividing your own property or evaluating land with division potential, understanding carbon county’s unique subdivision landscape is essential for making informed decisions.

contact me to discuss your property’s subdivision potential:

jon robinsonprincipal analyst, indigo flag llc

(267) 626-0787

jon@carboncountylandinsider.com

coming next: carbon county’s infrastructure development: what property owners need to know

in our next article, we’ll explore how current and planned infrastructure improvements are reshaping carbon county’s property landscape. we’ll examine road expansion projects, utility development initiatives, broadband connectivity progress, and how these changes affect property values in specific townships. understanding these infrastructure trends is crucial for identifying emerging opportunities and making informed long-term investment decisions in today’s evolving market.

You must be logged in to post a comment.